In the bustling world of construction, a performance bond serves as a safety net for project owners and stakeholders alike. As we delve into A Deep Dive into the History of Performance Bonds in Construction, we’ll explore their origins, evolution, importance, and future trends. This comprehensive article aims to shed light on how these financial instruments have shaped the construction industry over time.

What is a Performance Bond?

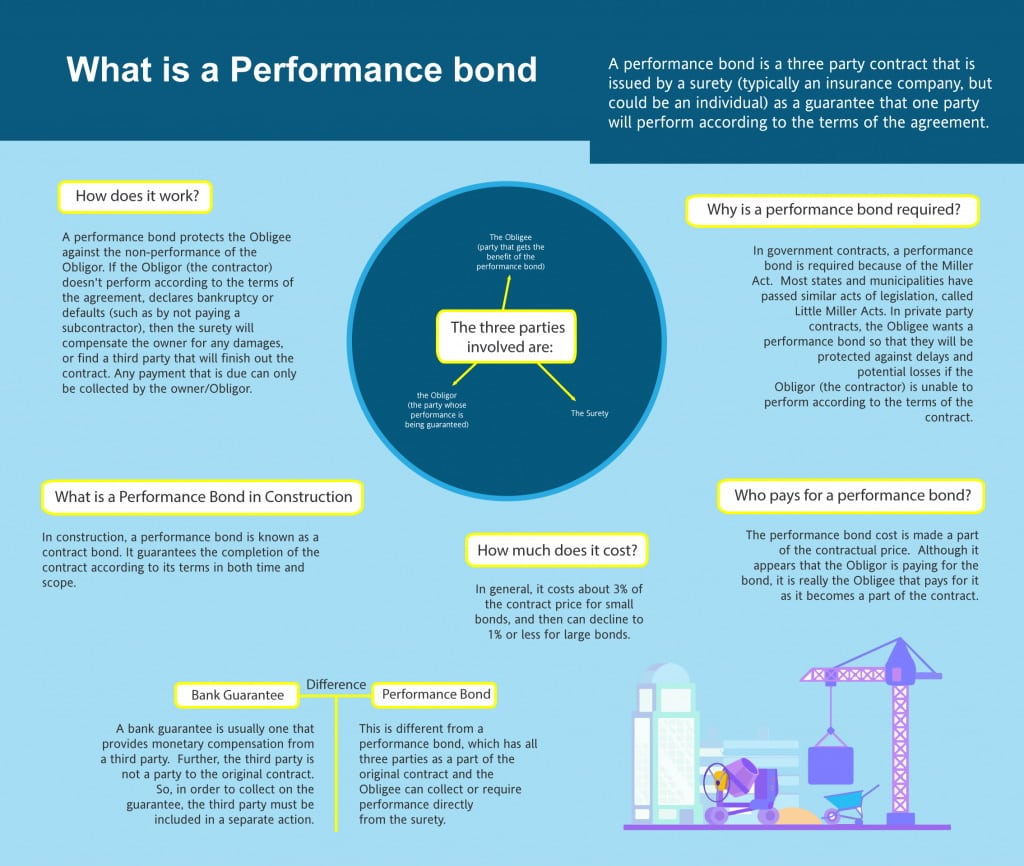

A performance bond is essentially a guarantee issued by a third party—usually an insurance company or bank—that ensures a contractor will fulfill their contractual obligations. If they fail to do so, the bond covers any financial losses incurred by the project owner. This mechanism provides peace of mind to stakeholders who invest significant resources into construction projects.

Types of Performance Bonds

Not all performance bonds are created equal. Here’s a breakdown:

- Contractor Performance Bonds: These are the most common in construction and ensure that contractors complete their work as per contract specifications. Supply Bonds: These ensure that suppliers provide materials as agreed upon in contracts. Bid Bonds: These are used during the bidding process and guarantee that a contractor will undertake the project if selected.

How Do Performance Bonds Work?

When a contractor applies for a performance bond, they undergo scrutiny to assess their financial stability and capability to complete the project. If approved, they pay a premium based on the bond amount. In case of default, the surety company pays out up to the bond's limit to cover losses.

The Historical Context of Performance Bonds

The concept of performance bonds can be traced back to ancient civilizations where merchants sought guarantees for transactions. However, modern performance bonds began taking shape in England during the 19th century, primarily Swiftbonds application process due to burgeoning industrialization.

Early Beginnings in England

The Industrial Revolution saw rapid growth in construction projects, necessitating more formalized financial assurances. Contractors began seeking guarantees from banks and other institutions to secure large projects.

Evolution through Legislation

Various laws were enacted throughout history that impacted performance bonds:

The Miller Act (1935): This U.S. legislation required performance bonds for federal contracts over $100,000. State Variations: Different states adopted similar measures leading to widespread use of performance bonds across public works projects.Importance of Performance Bonds in Construction Projects

Performance bonds play an indispensable role in risk management within construction projects:

- Financial Security: They protect project owners from potential losses. Trust Building: They foster trust between contractors and clients. Regulatory Compliance: Many jurisdictions mandate their use for public projects.

Benefits of Using Performance Bonds

Risk Mitigation: They substantially reduce the risk involved in hiring contractors. Enhanced Credibility: Contractors with performance bonds often enjoy greater credibility among clients. Legal Protection: They provide legal recourse if contract terms aren’t met.Challenges Associated with Performance Bonds

Despite their advantages, there are challenges tied to performance bonds:

- Cost Implications: Securing a performance bond involves costs that can burden smaller contractors. Complexity: The application process can be intricate and time-consuming. Limitations on Coverage: Not all potential risks may be covered under standard performance bonds.

Navigating Challenges Effectively

To navigate these challenges effectively:

Choose Wisely: Select reputable surety companies that understand your business needs. Understand Terms: Be clear about what is covered under your bond agreement. Budget Accordingly: Factor in bonding costs when planning your budget.A Deep Dive into Modern Practices of Performance Bonds

As we move forward into contemporary practices surrounding performance bonds, it's essential to consider technological advances alongside evolving regulations.

Technological Innovations Impacting Performance Bonds

Digital platforms have revolutionized how performance bonds are secured and managed:

- E-Bonding Solutions: Online portals streamline applications and approvals. Blockchain Technology: Offers enhanced transparency and security features for transactions involving performance bonds.

Shifting Regulatory Landscapes

With increasing emphasis on accountability within construction projects, regulatory bodies continually adapt requirements related to performance bonds:

Case Studies Highlighting Performance Bond Utilization

Examining real-world examples provides insight into how effective performance bonds can be:

Case Study 1: The Big Dig Project (Boston)

One of America’s largest infrastructure projects faced significant delays and cost overruns but utilized robust bonding strategies for risk management.

Key Takeaways:

- Importance of managing multiple contractors simultaneously with appropriate bonding coverage.

Case Study 2: California High-Speed Rail Project

This ambitious project employs various bonding techniques ensuring accountability among its numerous contractors while navigating complex regulations.

Key Takeaways:

- The need for ongoing assessments regarding contractor capabilities amid changing circumstances.

Frequently Asked Questions (FAQs)

1. What happens if a contractor defaults on a project?

If a contractor defaults, the surety company steps in to honor its obligation under the bond agreement—typically compensating project owners up to the bond's limit.

2. Are all contractors required to have performance bonds?

Not always; it depends on local laws and project size/requirements—many public contracts necessitate them while private contracts may not.

3. How much does it typically cost to obtain a performance bond?

Costs vary based on project size but generally range from 0.5% - 3% of the total contract value depending on risk factors associated with contractors’ credit scores and experience levels.

4. Can subcontractors also be bonded?

Yes! Subcontractors can secure their own separate performance bonds which adds another layer of protection for general contractors or project owners.

5. What documents are needed when applying for a performance bond?

Commonly required documents include financial statements, credit histories, resumes showcasing relevant experience/projects completed by contractors/subcontractors involved in work being bonded along with detailed plans outlining how work will be performed satisfactorily according contractual standards set forth by owners/clients involved!

6. How long does it take to get approved for one?

Approval times vary widely depending on complexity but generally take anywhere from days up until several weeks depending upon thoroughness during initial assessment phases conducted by surety providers prior issuance approval!

Conclusion

In summary, A Deep Dive into the History of Performance Bonds in Construction illustrates just how integral these financial instruments have become within this ever-evolving industry landscape—from humble beginnings rooted deeply within trade practices dating back centuries ago right up until today’s highly sophisticated technological advancements shaping future expectations surrounding accountability amongst various parties involved throughout entire processes undertaken! Ultimately understanding both historical contexts driving development alongside current practices equips stakeholders better navigate complexities inherent therein ensuring successful outcomes achieved through robust protections guaranteed via carefully crafted strategies inclusive effective utilization provided via these invaluable tools available–performance bonds!