Introduction

Navigating the landscape of environmental compliance can feel like walking through a dense forest without a map. With regulations rapidly evolving, businesses often find themselves daunted by the prospect of ensuring Click for more info compliance with environmental laws. One crucial tool that can help navigate these complexities is an environmental compliance bond. In this article, we will delve into what these bonds are, why they are essential, and how to effectively manage them. With insights drawn from industry experts and extensive research, this comprehensive guide aims to shed light on the intricacies involved in obtaining and maintaining environmental compliance bonds.

What is a Surety Bond?

When discussing environmental compliance bonds, it’s important first to understand the concept of a surety bond.

Defining Surety Bonds

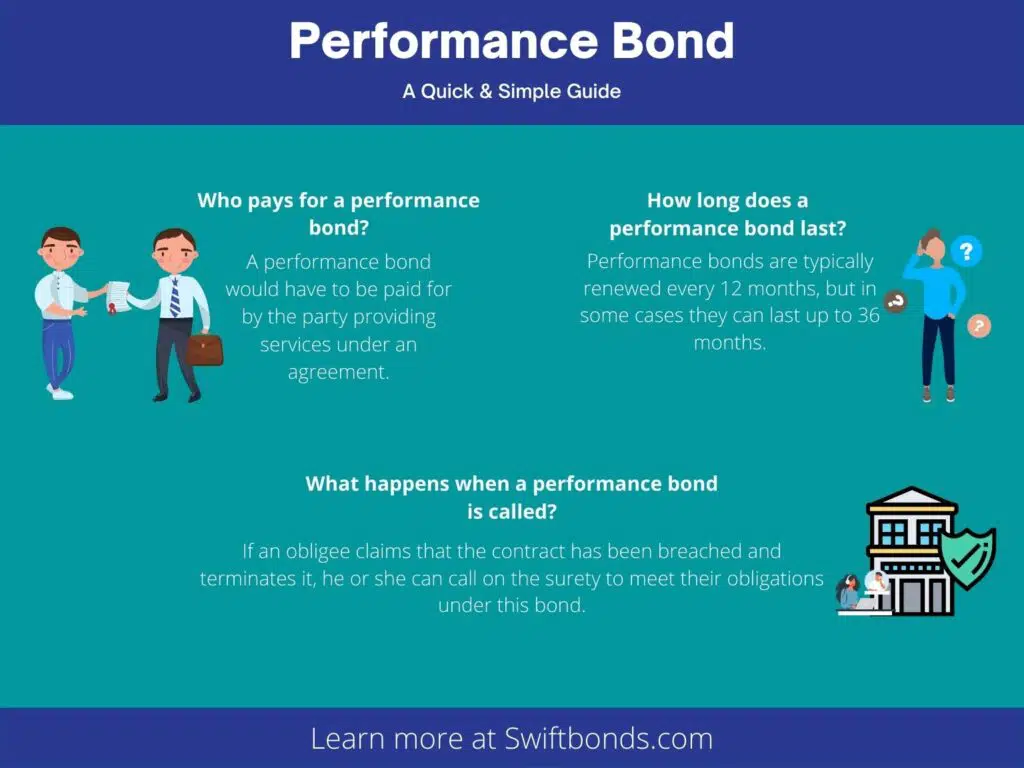

A surety bond is a three-party agreement that guarantees one party (the principal) will fulfill their obligations to another party (the obligee). In the context of environmental compliance, the obligee is typically a government agency that requires businesses to adhere to certain regulations.

The Parties Involved

Principal: The entity required to obtain the bond. Obligee: The party requiring the bond—usually governmental bodies enforcing environmental regulations. Surety: The company that issues the bond and guarantees payment or performance if the principal fails in their obligations.Why Surety Bonds Matter

Surety bonds serve as a safety net for regulatory agencies, ensuring that funds are available for remediation or other necessary actions if companies fail to comply with environmental standards.

Understanding Environmental Compliance Bonds

What Are Environmental Compliance Bonds?

Environmental compliance bonds are specific types of surety bonds designed to ensure that businesses adhere to environmental laws and regulations. These bonds provide financial assurance that businesses will undertake necessary actions to mitigate pollution or restore areas impacted by their operations.

Purpose of Environmental Compliance Bonds

These bonds serve multiple purposes:

- Ensure financial resources are available for cleanup efforts. Deter non-compliance by imposing financial penalties. Protect public interests by holding businesses accountable.

The Importance of Environmental Compliance Bonds

Why Every Business Should Consider Them

For businesses operating in sectors such as construction, mining, or waste management, environmental compliance bonds are not just optional; they are often mandatory.

Protecting Public Health and Safety

Having these bonds in place helps ensure that companies take adequate measures to protect public health and safety from potential environmental hazards.

Enhancing Corporate Reputation

Maintaining compliance with environmental regulations not only satisfies legal requirements but also enhances a company's reputation among stakeholders.

Key Components of Environmental Compliance Bonds

Coverage Amounts

The coverage amount reflects the financial commitment required by the obligee. It’s essential for businesses to understand how these amounts are determined based on potential liabilities.

Bond Duration

Typically tied to project timelines or operational periods, understanding how long a bond remains effective is crucial for business planning.

Renewal Options

Some bonds may require renewal after certain periods. Knowing when and how often you need to renew can save headaches later on.

How Are Environmental Compliance Bonds Obtained?

Step-by-Step Process for Securing a Bond

Assessment of Needs: Understand your specific bonding requirements based on your operations and jurisdiction. Choosing a Surety Company: Research reputable sureties experienced in handling environmental compliance. Application Process: Complete necessary applications providing all required documentation related to your company's financial history and operational practices. Underwriting Procedures: The surety company will assess risk factors before issuing the bond. Bond Issuance: Once approved, pay any associated fees before receiving your bond documentation.Costs Associated with Environmental Compliance Bonds

Factors Influencing Bond Costs

Several factors influence how much you'll pay for an environmental compliance bond:

- Creditworthiness Type of business operation Risk assessment by the surety company

Typical Cost Ranges

While costs can vary widely depending on these factors, businesses should expect premiums generally ranging from 1% to 15% of the total obligation amount annually.

Regulatory Framework Governing Environmental Compliance Bonds

Federal Regulations

The U.S. federal government has established various guidelines that dictate when and how these bonds must be used across industries.

Examples:

- Resource Conservation and Recovery Act (RCRA) Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA)

State Regulations

Each state may have additional requirements regarding bonding based on localized environmental concerns.

Challenges in Managing Environmental Compliance Bonds

Common Hurdles Faced by Businesses

Understanding complex regulatory requirements can be overwhelming. Financial constraints may limit bonding options. Misunderstandings about coverage limitations could lead to exposure during claims.Mitigation Strategies

To effectively manage these challenges:

- Engage with legal experts specializing in environmental law. Maintain open communication with your surety provider about changing needs or circumstances.

The Role of Technology in Bond Management

Innovations Streamlining Processes

Technology plays an increasingly significant role in managing compliance obligations efficiently:

Online platforms allow easier access to information regarding bonding requirements. Software solutions help track deadlines associated with renewals or changes in coverage needs.Best Practices for Maintaining Your Environmental Compliance Bond

Ensuring Ongoing Compliance

Maintaining an active understanding of evolving regulations is key:

Regular training sessions for employees regarding best practices concerning environmental responsibilities. Periodic reviews of existing contracts involving compliance obligations.FAQs About Environmental Compliance Bonds

What happens if I fail to comply with my bond terms?

Non-compliance can lead not only to financial penalties but also potential legal action against your business by regulatory authorities.

Are there different types of environmental compliance bonds?

Yes! Depending on specific operations or industry needs, different kinds exist including performance bonds or maintenance bonds.

Can I appeal if my bond application gets denied?

Absolutely! Most sureties allow appeals where you can present additional information for reconsideration.

Is there an expiration date on my bond?

Yes; most have specified durations which must be adhered too unless renewed before expiration.

What documentation do I need when applying for an environmental compliance bond?

Typically require financial statements along with an overview detailing past operational practices relevant towards meeting obligations.

6. How do I choose reputable surety providers?

Researching online reviews alongside consulting industry peers who’ve had positive experiences offers insight into trustworthy companies.

Conclusion: Moving Forward with Confidence

Navigating the complexities surrounding environmental compliance bonds doesn’t have to feel like traversing through uncharted territory alone! By gaining thorough knowledge about what constitutes these vital tools—what is a surety bond—and understanding applicable regulations while leveraging technology wisely—you’ll be well-equipped moving forward confidently within this intricate landscape!

Remember: Staying informed means staying compliant; thus protecting both your business interests while prioritizing our planet’s wellbeing!