Introduction

In the bustling world of construction, subcontractors play a crucial role in driving projects forward. However, the complexities that arise can lead to financial and legal challenges. This is where subcontractor bonds come into the picture. Understanding Subcontractor Bonds and Their Significance is vital for anyone involved in the construction industry—be it contractors, subcontractors, or project owners. These bonds act as a safety net, ensuring that projects are completed on time and within budget while protecting all parties involved from potential mishaps.

In this article, we'll delve deep into the concept of subcontractor bonds, exploring their nuances, types, and benefits. We will also discuss how bonding companies contribute to this ecosystem, ensuring that everyone plays by the rules. So buckle up as we navigate through this essential topic!

What Are Subcontractor Bonds?

Definition of Subcontractor Bonds

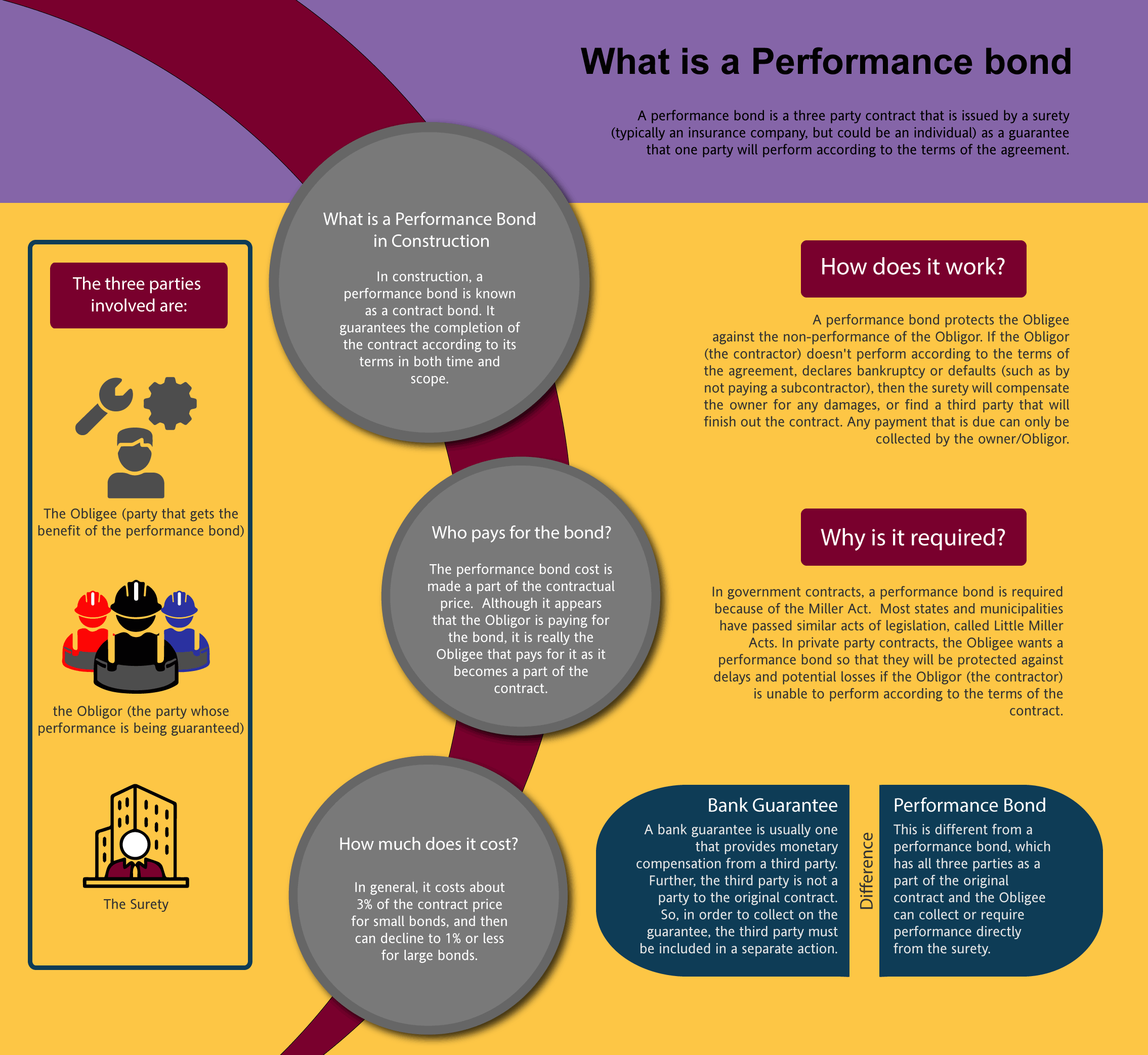

Subcontractor bonds are a type of surety bond designed to protect project owners against financial loss caused by a subcontractor's failure to fulfill their contractual obligations. They serve as a guarantee that subcontractors will complete their work according to the terms specified in their contracts.

Types of Subcontractor Bonds

Performance Bonds- Ensure that the subcontractor will complete their work as per contract specifications.

- Guarantee that subcontractors will pay their suppliers and laborers.

- Protect project owners if a subcontractor bids but fails to enter into a contract.

- Cover repairs during a certain period post-completion.

How Do Subcontractor Bonds Work?

When a subcontractor enters into an agreement with a general contractor or project owner, they must obtain these bonds from a bonding company. The bonding company assesses the subcontractor's financial stability and capability before issuing the bond. If the subcontractor fails to meet their obligations, claims can be made against the bond.

The Role of Bonding Companies

What is a Bonding Company?

A bonding company is an entity that issues surety bonds to contractors and subcontractors after evaluating their creditworthiness and business practices. They act as intermediaries between project owners and subcontractors, providing financial protection and assurance.

Why Choose a Reputable Bonding Company?

Choosing a reputable bonding company can make all the difference in securing your project's success:

- Financial Security: A reliable bonding company mitigates risks associated with contractor defaults. Reputation Management: It enhances your credibility in the eyes of clients and stakeholders. Expertise: Established companies often provide invaluable insights into best practices in project management.

Benefits of Subcontractor Bonds

performance bondsProtection for Project Owners

One of the most significant advantages of having subcontractor bonds is safeguarding project owners from financial losses due to non-performance or payment issues by subcontractors.

Confidence for General Contractors

General contractors can rest easy knowing they have recourse if things go awry with their chosen subcontractors.

Encourages Compliance with Regulations

Subcontractors are encouraged to adhere closely to laws and regulations when they know they are bonded.

Understanding Subcontractor Bonds and Their Significance for Financial Health

Impact on Cash Flow Management

Having bonds in place can improve cash flow management for both contractors and project owners since it minimizes unforeseen costs arising from contract breaches.

Easier Access to Financing

Bonded contracts may make it easier for subcontractors to secure financing from banks or other lending institutions since they demonstrate reliability.

How to Obtain a Subcontractor Bond?

Steps Involved in Securing Your Bond

Choose a qualified bonding company. Complete an application process. Provide necessary documentation (financial statements, work history). Undergo an assessment process. Receive your bond once approved!FAQs About Subcontractor Bonds

1. What happens if my bonded subcontractor fails to perform?

If your bonded subcontractor fails to perform, you can file a claim against their bond through the bonding company for compensation or completion of work.

2. How much does it cost to get bonded?

The cost varies based on several factors like credit score, bond amount required, and type of bond but typically ranges from 1% to 15% of the total bond amount.

3. Can any contractor get bonded?

Not every contractor qualifies; bonding companies assess creditworthiness, financial stability, prior experience, etc., before issuance.

4. How long does it take to obtain a bond?

The duration varies; however, once all documents how to obtain performance bonds are submitted correctly, it usually takes anywhere from one day up to several weeks depending on complexity.

5. Are there different requirements for different states?

Yes! Each state has unique regulations regarding contracting and bonding requirements which you must comply with.

6. What should I do if my claim is denied?

If your claim against a bond is denied, you can appeal through legal channels or consult with an attorney specializing in construction law for further options.

Conclusion

In conclusion, understanding subcontractor bonds is not just beneficial but essential for anyone operating within the construction industry framework—be it general contractors or project owners seeking peace of mind when hiring subcontractors. With backing from trustworthy bonding companies ensuring compliance with regulations while promoting accountability among parties involved makes these bonds indispensable tools for mitigating risk effectively!

By grasping these concepts— Understanding Subcontractor Bonds and Their Significance—you empower yourself with knowledge crucial for navigating this often complex landscape smoothly while laying down solid foundations upon which successful projects are built!