Introduction

In today's business landscape, trust and reliability are paramount. Whether you're a construction manager seeking financial backing or a motor vehicle dealer needing a motor vehicle dealer bond, the selection of a surety provider can significantly impact your cost of performance bonds operations. This article delves into why reputation matters when choosing a surety provider, examining how it influences your projects' success and overall peace of mind.

Why a Good Reputation Matters When Choosing a Surety Provider

When it comes to selecting a surety provider, the old adage "you get what you pay for" rings true. A reputable surety company not only provides bonds but does so with integrity, transparency, and an understanding of the industry. Here's why reputation is crucial:

1. Credibility in the Market

A surety provider with an excellent reputation has likely built credibility over years of reliable service. They have earned their place in the market by consistently fulfilling their obligations and maintaining strong relationships with clients.

1.1 Building Trust

Trust is not something that can be easily acquired; it takes time. A reputable surety provider will have testimonials and case studies that speak volumes about their reliability.

2. Financial Stability

Reputable providers often exhibit greater financial stability, which can be critical for larger projects or contracts requiring substantial bonds.

2.1 Assessing Financial Health

Before entering into any agreement, it's essential to assess the financial ratings and health of potential surety providers. Organizations like AM Best provide ratings that can help gauge this aspect.

3. Industry Expertise

A well-regarded surety provider usually possesses extensive industry knowledge and experience, which translates into better support for your specific needs.

3.1 Tailored Solutions

They can offer more tailored solutions based on your particular requirements—be it for construction bonds or motor vehicle dealer bonds—thus helping you to navigate complexities more effectively.

4. Customer Service Excellence

The level of customer service provided by a surety company can greatly affect your experience as a client.

4.1 Responsiveness and Support

A good reputation typically correlates with superior customer service; reputable firms are quick to respond to inquiries and provide ongoing support throughout the bonding process.

5. Risk Management Capabilities

A reputable surety provider will also have robust risk management systems in place that protect both themselves and their clients from unforeseen challenges.

5.1 Mitigating Risks Effectively

By understanding your unique risks, they can help you mitigate them through appropriate bonding solutions tailored specifically to your situation.

6. Legal Compliance Assurance

When dealing with certain industries—like motor vehicle sales—legal compliance is crucial; thus, working with reputable providers ensures adherence to regulations.

6.1 Avoiding Legal Pitfalls

An established surety provider will be familiar with the legal landscape and can assist you in avoiding potential pitfalls related to compliance issues.

7. Reputation Among Peers

Another aspect worth considering is how other professionals within your industry view the potential surety providers.

7.1 Seeking Recommendations

It’s advisable to seek recommendations from peers or associations that work closely with these companies; word-of-mouth carries significant weight in building trust.

8. Transparency in Agreements

A good reputation also reflects transparency in dealings, allowing you to understand all terms before signing on the dotted line.

8.1 Clarity Over Hidden Costs

Reputable providers will clarify all costs associated with securing bonds without burying fees in fine print—a crucial factor when budgeting for projects.

9. Longevity in Business

Companies that have been around for several years often possess invaluable insights into market trends and practices that newer competitors may lack.

9.1 Experience Counts

Their longevity indicates they’ve successfully navigated economic fluctuations while serving various sectors, thus showcasing their resilience and adaptability.

Conclusion

Choosing a surety provider isn’t merely about getting bonded; it’s about partnering with someone who understands your needs and stands by you throughout every step of your journey—especially when considering something as important as a motor vehicle dealer bond or any other essential bond type specific to your industry sector.

FAQs

1. What is a Surety Bond?

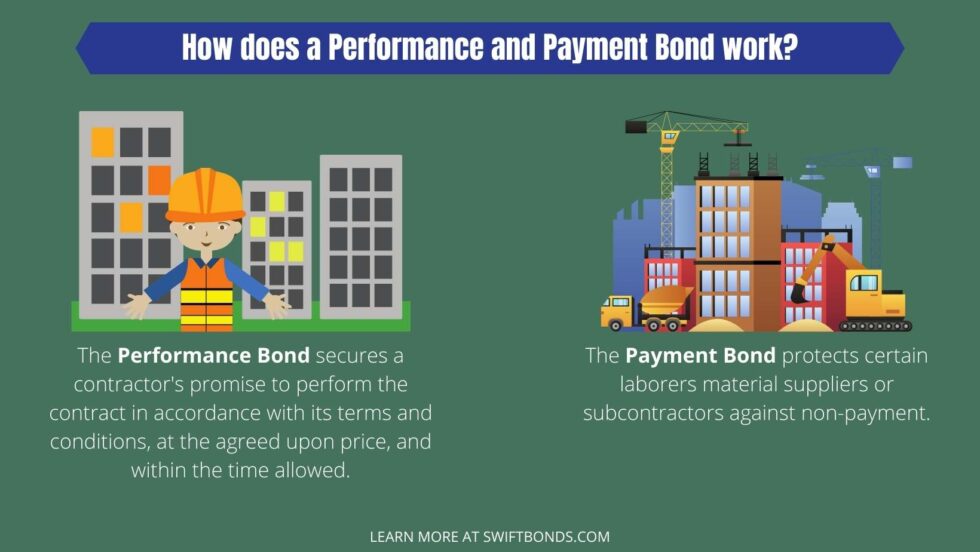

A surety bond is essentially an agreement between three parties: the obligee (the party requiring the bond), the principal (the party purchasing the bond), and the surety (the party providing the bond). It guarantees that the principal will fulfill obligations set forth by the obligee.

2. How Does One Choose the Right Surety Provider?

Look at factors such as financial stability, customer reviews, responsiveness, industry expertise, and whether they specialize in bonds relevant to your field (like motor vehicle dealer bonds).

3. Are All Sureties Created Equal?

No! Not all sureties have equal reputations or capabilities; thus it's vital to research thoroughly before making any commitments.

4. What Happens if I Default on My Obligations?

If you default on your obligations under a bond agreement, the surety will step in but may pursue reimbursement from you after covering claims made against the bond.

5. Can I Get Multiple Bonds from One Provider?

Yes! Many reputable providers offer various types of bonds including performance bonds, payment bonds, license bonds like motor vehicle dealer bonds etc., making it easier for businesses needing multiple coverage options.

6: How Long Does It Take To Obtain A Bond?

The timeframe depends on several factors including documentation required by both parties involved but typically ranges from one day up until several weeks depending upon complexity involved.

Conclusion

In summary, understanding why reputation matters when choosing a surety provider helps illuminate how pivotal these considerations are for safeguarding business interests effectively while ensuring compliance along every aspect of operations – especially when acquiring specialized bonding such as a motor vehicle dealer bond! Your choice should always reflect quality over cost alone; investing time upfront pays off down-the-line through smoother project execution paired alongside peace-of-mind knowing you've partnered wisely within this critical segment!